Restructuring

Lawyers

We understand the intricacies of corporate restructuring in the UK landscape. Trust us to tailor legal solutions that align with your business goals, enabling you to navigate changes effectively and emerge stronger. Your success is our priority.

Restructuring a business

Our expertise in corporate restructuring ensures your business navigates transformative changes seamlessly. Our tailored solutions encompass demergers, Employee Ownership Trusts (ETOs), mergers and acquisitions (M&As), and the strategic separation of property from trading operations.

Demergers

When businesses need to realign their structures, our legal team facilitates demergers, ensuring a smooth separation of entities to optimise efficiency and focus.

Employee Ownership Trusts (EOTs)

EOTs are a great way for shareholders to realise the value of their business, and exit in a tax-efficient manner. If certain qualifying conditions are satisfied, the selling shareholders will pay no capital gains tax on the sale of their shares.

An EOT is a trust which is implemented to facilitate employee ownership. The trust purchases a ‘controlling interest’ in the target company (i.e. more than 50% of the company’s shares), and holds the shares purchased for the benefit of the company’s employees.

Selling to an EOT empowers employees by facilitating their ownership of the business and participation in its profits, whilst also fostering a sense of shared responsibility and commitment.

We have extensive experience in EOT transactions, allowing an exit that benefits all parties.

Mergers and Acquisitions

Navigating the complexities of M&As demands legal finesse. Our experts guide clients through every stage, from due diligence to post-transaction integration, ensuring a seamless process.

Separation of Property from Trading

Efficiently separating property assets from trading operations is crucial. We provide strategic counsel to safeguard your interests and maximise operational effectiveness.

Core Business and Ancillary Separation

Identifying and separating core business functions from ancillary operations requires precision. Our team ensures a streamlined process, protecting your core assets and promoting sustained growth.

Group Reorganisations and Structuring

Streamlining and reorganising groups of companies can improve operational and tax efficiencies for businesses and their shareholders.

Structuring groups of companies is particularly important, because:

- UK tax legislation gives special treatment to certain transactions between group members, such as corporation tax exemptions for assets being transferred between groups; and

- bringing disparate investment companies into a single group can strengthen and streamline shareholders applications for tax clearance for Business Property Relief (BPR) from inheritance tax upon their death.

Our legal team provides expert advice to structure groups of companies in the most efficient manner, whilst tailoring them specifically to each businesses individual goals and needs.

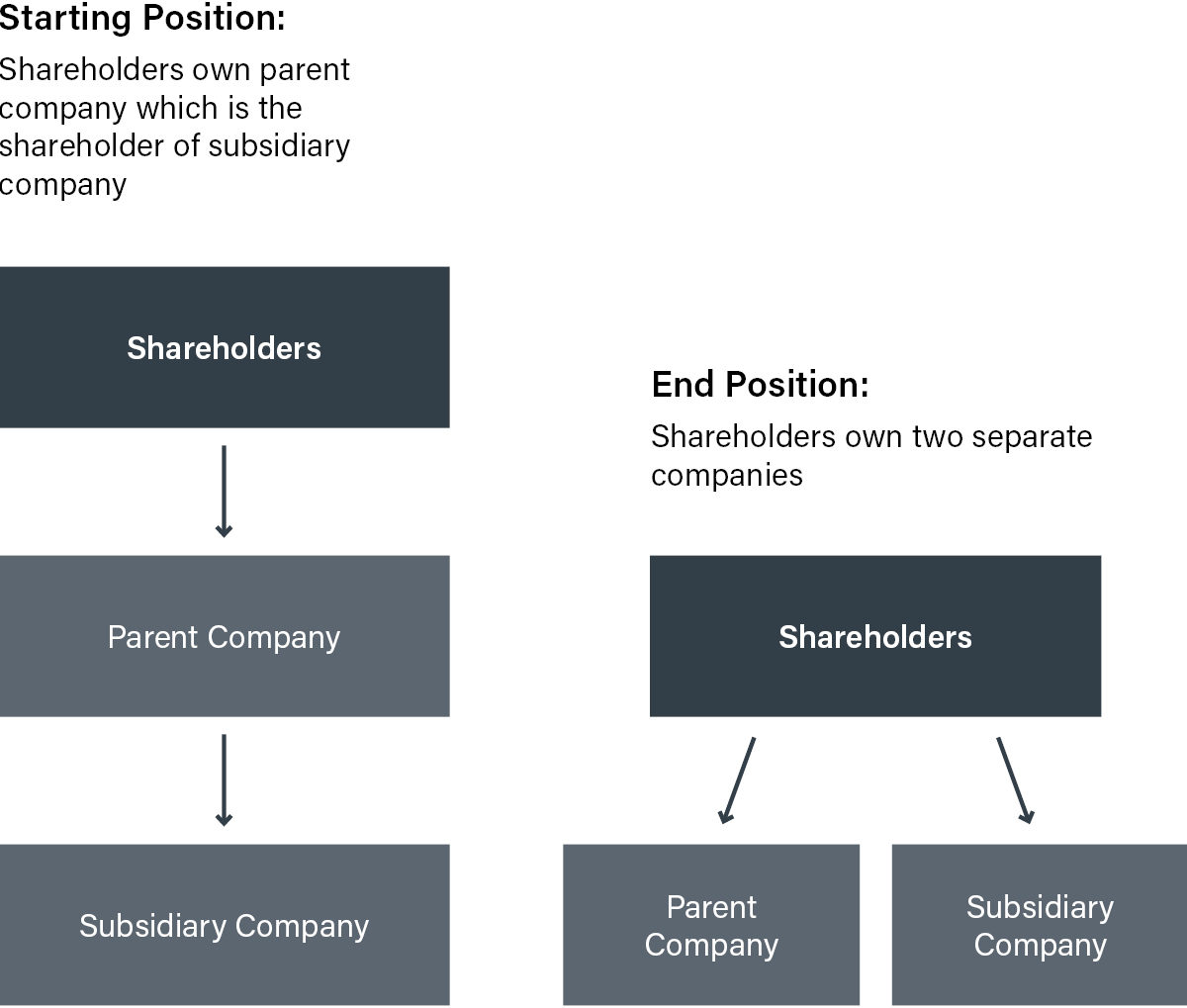

Direct Dividend Demerger

A dividend in specie is a dividend of assets (e.g. property, intellectual property) instead of cash. A direct dividend demerger is where a company declares a dividend in specie of certain assets which are then transferred directly to the company’s shareholders.

A direct dividend demerger can be used to split a corporate group by a parent company declaring a dividend in specie of the shares in a subsidiary. The subsidiary is then transferred to the shareholders. The parent company must have sufficient distributable reserves (i.e. accumulated profits after tax) up to the book value of the shares in the subsidiary.

This is a simple structure, and may be a tax-efficient “exempt distribution” if certain criteria are met, meaning it will not attract income tax for the company’s shareholders or shadow advance corporation tax for the company. Amongst other criteria, for the dividend in specie to be an “exempt distribution” the shares in the subsidiary company being demerged must be at least 75% owned by the parent company.

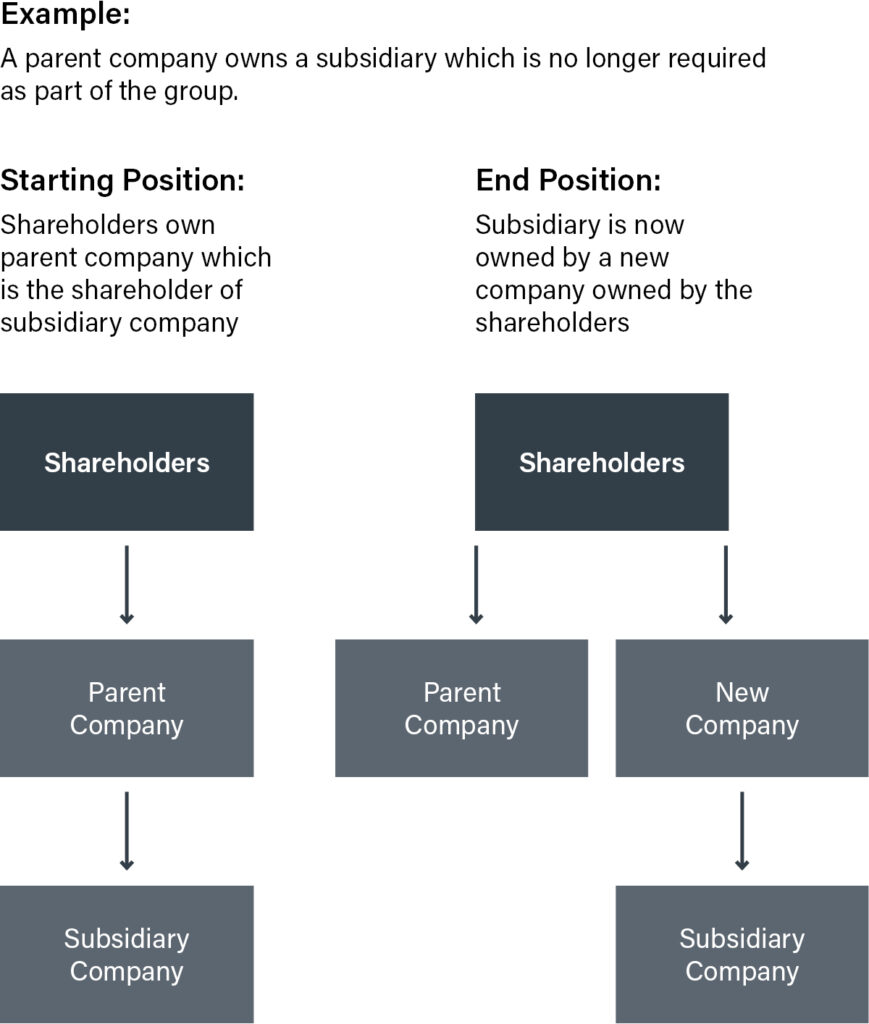

Three-Cornered Demerger

A dividend in specie is a dividend of assets (e.g. property, intellectual property) instead of cash. An indirect dividend demerger is where a company declares a dividend in specie of certain assets and those assets are transferred to a company owned by the shareholders.

A three-cornered demerger can be used to split a corporate group by a parent company declaring a dividend in specie of the shares in a subsidiary. The subsidiary is then transferred to a new company owned by the shareholders. The parent company must have sufficient distributable reserves (i.e. accumulated profits after tax) up to the book value of the shares in the subsidiary.

Amongst other potential tax benefits, this may be a tax-efficient “exempt distribution” if certain criteria are met, meaning it will not attract income tax for the issue of shares in the new company to the company’s shareholders or shadow advance corporation tax for the distributing company. Amongst other criteria, for the dividend in specie to be an “exempt distribution” the shares in the subsidiary company being demerged must be at least 75% owned by the parent company.

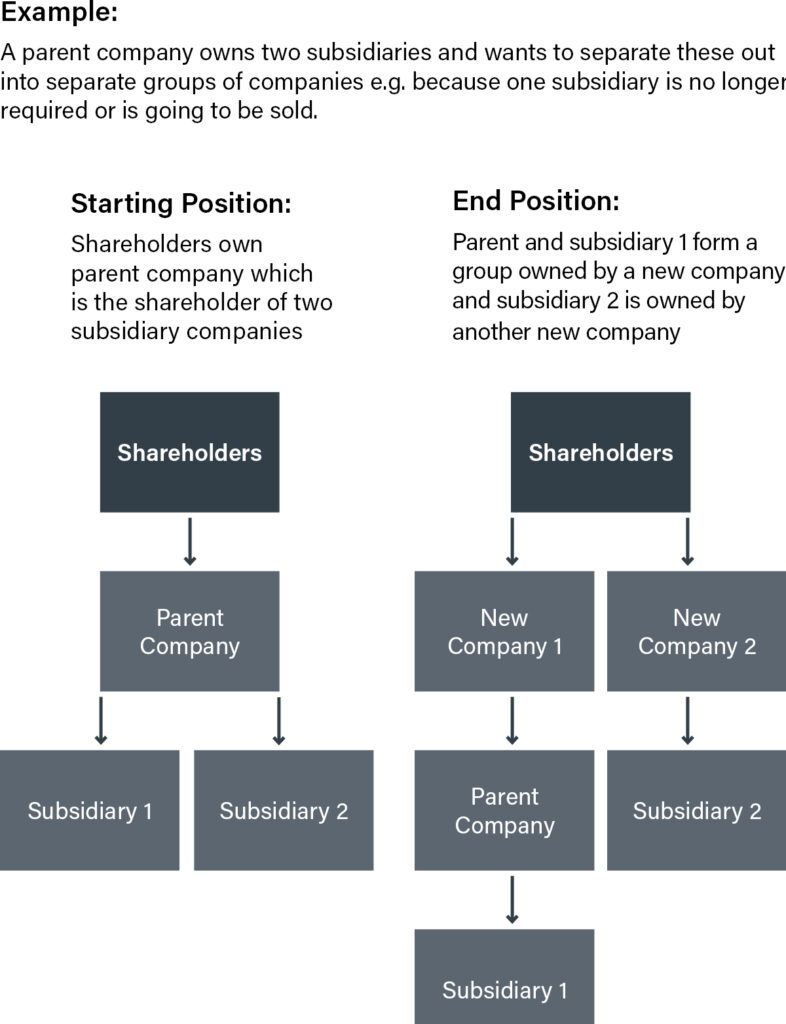

Capital Reduction Demerger

A capital reduction demerger is where a company reduces its share capital and simultaneously transfers assets to a company owned by its shareholders.

A capital reduction demerger can be used to split a corporate group by a parent company transferring a subsidiary to a new company owned by the shareholders. This structure does not require the company to have distributable reserves, and does not give rise to a corporation tax charge for the distributing company provided the amount repaid as part of the capital reduction is equal to the value of the business that is demerged to the shareholders. Moreover, provided the shareholders receive New Parent shares as part of a qualifying scheme of reconstruction, they are not treated as having disposed of their shares for capital gains tax purposes.

FAQs

Why undergo a corporate restructuring?

Companies may undergo a restructuring for various reasons, which may include:

- adapting to changing market conditions

- improving operational efficiency

- addressing financial challenges

Ultimately, the goal is to enhance the company’s long-term viability and create value and this may be done using methods such as acquisitions, demergers, or financial reorganizations.

Legal frameworks, such as the Companies Act, provide guidelines for these processes, ensuring transparency, protecting stakeholders’ rights, and facilitating the company’s ability to adapt and thrive in a dynamic business environment.

What will happen to the employees and assets on corporate restructuring?

In a corporate restructuring the handling of employees and assets can vary based on the nature of the restructuring.

Employees

Employees’ rights are protected by employment laws, and upon an acquisition, for example, existing employment contracts may transfer to the new entity via procedure set out in the Transfer of Undertakings (Protection of Employment) Regulations, commonly referred to as “TUPE”. The TUPE procedure ensures fairness and protection for both employees, with consultation and transparency playing key roles in mitigating the impact of a corporate restructuring upon employees, however, this may come with changes to the employees’ roles or conditions.

Assets

How the assets are handled in a corporate restructuring can vary greatly and will depend upon the specific method of restructuring used. For example, if the restructuring includes an acquisition, the assets may transfer to the acquiring company whilst, upon a demerger, the assets may be split between the various entities.

How is corporate restructuring regulated?

Corporate restructuring is subject to various UK legal frameworks, most notably the Companies Act 2006, which include guidelines for approval processes and creditor rights, among other aspects of restructuring. Approval may be required from shareholders, creditors and regulatory authorities, among other interested parties, and the approvals required will depend upon the nature of the restructuring taking place.

Legal Insight

Meet the Team

Related expertise

Best Law Firms 2024

Herrington Carmichael has once again been named in the Times Best Law Firms. We were first listed in 2023 and have once again made the Best Law Firms list for 2024.