Charity Lawyers

Our Not-for-profit and Charities team are here to assist in establishing not-for-profit organisations, including incorporated or regulated bodies.

Charity & Not-for-profit

We assist individuals with the formation of not-for-profit organizations, including charities and foundations, and help with the registration process for other incorporated bodies, ongoing governance, and advising on general legal issues. Our goal is to imbue our clients’ first steps into the not-for-profit sector with a sense of security and readiness. We cover the updating of constitutional documentation and the closing down of entities that are no longer required.

Charitable Organisations

Our Charities and Not-for-profit team can guide you through the process of setting up and managing a Charitable Incorporated Organization (“CIO”).

What is a Charitable Incorporated Organization?

A CIO is a charity that has its own legal identity and comes into existence as soon as it is registered at the Charity Commission. A CIO must have trustees who manage the organization.

What is a Foundation and Association Model CIO?

A CIO can choose between two different structures; the foundation or association models. What differentiates these two models is their management structure. In foundation model CIOs, trustees and members are the same people, whereas association model CIOs leave membership open to non-trustees.

What do our Services Include?

Our expertise extends to:

- Formulating your mission statement.

- Defining your charitable objects.

- Drafting the constitution.

- Ongoing governance assistance.

If you have any questions, please contact us. If you have any queries outside the scope of our expertise, we can put you in touch with others who are able to advise you.

Community Amateur Sports Club

If you have a sports club based in the UK, and satisfy the conditions listed below, our Charities and Not-for-profit team can help your club register as a Community Amateur Sports Club (CASC).

What is a CASC?

Introduced in 2002, a CASC is a registerable status granted to sports clubs which satisfy a set of qualifying conditions. Once a club registers as a CASC, they are exempt from certain tax requirements, such as tax on trading profits (if the club’s income is below £50,000). They are not companies and are registered with HMRC.

Qualifying Conditions:

- The club is open to the whole community

- Its membership costs are limited to a specified amount

- It’s organised on an amateur basis

- Its main purpose is for the provision, promotion or participation in one or more eligible sports

- The club’s income limit is not exceeded

- It meets location requirements

- Meets the management condition

- The club is non-profit making, and any surplus turnover is reinvested into the club.

If you have any questions relating to CASCs, please feel free to reach out at. If we are unable to answer any of your queries, we are happy to put you in contact with advisers that can.

Unincorporated Charities

What is an Unincorporated Charity?

An unincorporated charity is simply an individual or group of people operating as a not-for-profit organisation under the same name for a legally valid charitable purpose. Since these associations are unincorporated, they are not treated by the law as legal individuals. This means that the association’s members do not benefit from limited liability, rendering them personally liable to the charity’s financial obligations.

Our Services:

Our Charities team deliver advise in a bespoke manner, and can help your unincorporated association acquire charitable status, by:

- Identifying your charitable purposes and whether they are for the public benefit

- Defining your mission statement

- Helping you comply with statutory and regulatory requirements

- Advising on alternative legal structures that meet your individual needs

Please feel free to reach out. Should you have any queries that we are unable to satisfy, we can put you in touch with advisers that can.

Charitable Foundations

What are Charitable Foundations?

A charitable foundation is simply a charity that is funded by one individual or legal entity. Corporate Foundations specifically refer to foundations that are funded by a single corporate entity, such as a company or limited liability partnership.

Our Service:

- Setup your charity and advise on appropriate legal structures.

- Assist with identifying your charitable purpose

- Define your mission statement.

- Help you comply with statutory formalities.

Charitable Companies

Charitable Companies are a common legal structure for running a charity. They offer the same benefits as a company and are regulated by both charity and company law.

What is a Charitable Company?

A Charitable Company is an incorporated body registered as a charity at Companies House. As a corporate body, your charity is legally considered a person in the same way as an ordinary individual. This enables your charity to engage with legal matters in its own name, such as: employing staff, entering contractual agreements, and owning land and assets. Charitable Companies can only be limited by guarantee, which means they have no shareholders, only members who agree to contribute a pre-determined amount in the event of the charity being wound up (the guarantee).

Our core charity services

We deliver work that meets each client’s needs in a bespoke manner and offer legal support on an ad hoc basis. Our services include:

- Defining your charitable objects and mission statement.

- Assistance with attaining registered status.

- Ongoing governance support as required pre- and post-incorporation.

- Maintaining your statutory registers in electronic form.

- Handling all requisite filings.

- Your charity’s first board minute.

Should you have any queries outside the scope of our expertise, we are happy to put you in touch with others that can advise you.

Charity Structure

Choosing the correct structure for your charity depends on your aims, we can help you decide which structure is right for you.

Are your aims exclusively charitable?

I.e., not just for the benefit of the community? And, if so, does that purpose provide a public benefit? It’s important to understand what constitutes an exclusively charitable purpose.

Once you’ve established your charitable purpose, consider this:

Does a charity already exist that shares the same aims, benefits the same group of people, and operates in a similar location?

If you answered ‘Yes’, collaboration would be a better approach. Working together prevents charities from competing for resources and funding, allowing them to better serve their beneficiaries.

Are you aware of restrictions and Charity Compliance?

Being classed as a charity will restrict your activities and you should therefore ensure that the restrictions will not adversely affect your aims – for example, you will need to be aware of and comply with Charity Law, and provide up-to-date information on your activities, finances and leading personnel to the Charity Commission and possibly other bodies.

You will not be able to carry out certain political activities, you will need to be able to make independent decisions about the charity’s work and you (or anyone connected to you), as a founder or trustee, will not be able to benefit personally from the charity (without certain limited criteria being fulfilled).

If any of these adversely affect what you wish to do, then a charity is probably not the best option and you should consider an alternative form.

Charity Disputes

Our Dispute Resolution lawyers cover a full range of disputes from the complex and high value to the more modest. We represent clients in court, arbitration tribunals and use alternative procedures, including mediation, to resolve disputes.

Our Dispute Resolutin team can support you with:

- Business Disputes

- Contract Disputes

- Data Protection Breach

- Land & Property Disputes

- Intellectual Property Disputes

- Professional Negligence

- Debt Recovery

Dispute Resolution

Our Dispute Resolution lawyers cover a full range of disputes from the complex and high value to the more modest. We represent clients in the courts, arbitration tribunals and use alternative procedures, including mediation, to resolve disputes.

Our increasingly specialist legal practice includes a dedicated range of dispute resolution lawyers with a wide range of services to meet the demands of our UK and international clients.

Charitable Organisations

Our Charities and Not-for-profit team can guide you through the process of setting up and managing a Charitable Incorporated Organization (“CIO”).

What is a Charitable Incorporated Organization?

A CIO is a charity that has its own legal identity and comes into existence as soon as it is registered at the Charity Commission. A CIO must have trustees who manage the organization.

What is a Foundation and Association Model CIO?

A CIO can choose between two different structures; the foundation or association models. What differentiates these two models is their management structure. In foundation model CIOs, trustees and members are the same people, whereas association model CIOs leave membership open to non-trustees.

What do our Services Include?

Our expertise extends to:

- Formulating your mission statement.

- Defining your charitable objects.

- Drafting the constitution.

- Ongoing governance assistance.

If you have any questions, please contact us. If you have any queries outside the scope of our expertise, we can put you in touch with others who are able to advise you.

Community Amateur Sports Club

If you have a sports club based in the UK, and satisfy the conditions listed below, our Charities and Not-for-profit team can help your club register as a Community Amateur Sports Club (CASC).

What is a CASC?

Introduced in 2002, a CASC is a registerable status granted to sports clubs which satisfy a set of qualifying conditions. Once a club registers as a CASC, they are exempt from certain tax requirements, such as tax on trading profits (if the club’s income is below £50,000). They are not companies and are registered with HMRC.

Qualifying Conditions:

- The club is open to the whole community

- Its membership costs are limited to a specified amount

- It’s organised on an amateur basis

- Its main purpose is for the provision, promotion or participation in one or more eligible sports

- The club’s income limit is not exceeded

- It meets location requirements

- Meets the management condition

- The club is non-profit making, and any surplus turnover is reinvested into the club.

If you have any questions relating to CASCs, please feel free to reach out at. If we are unable to answer any of your queries, we are happy to put you in contact with advisers that can.

Unincorporated Charities

What is an Unincorporated Charity?

An unincorporated charity is simply an individual or group of people operating as a not-for-profit organisation under the same name for a legally valid charitable purpose. Since these associations are unincorporated, they are not treated by the law as legal individuals. This means that the association’s members do not benefit from limited liability, rendering them personally liable to the charity’s financial obligations.

Our Services:

Our Charities team deliver advise in a bespoke manner, and can help your unincorporated association acquire charitable status, by:

- Identifying your charitable purposes and whether they are for the public benefit

- Defining your mission statement

- Helping you comply with statutory and regulatory requirements

- Advising on alternative legal structures that meet your individual needs

Please feel free to reach out. Should you have any queries that we are unable to satisfy, we can put you in touch with advisers that can.

Charitable Foundations

What are Charitable Foundations?

A charitable foundation is simply a charity that is funded by one individual or legal entity. Corporate Foundations specifically refer to foundations that are funded by a single corporate entity, such as a company or limited liability partnership.

Our Service:

- Setup your charity and advise on appropriate legal structures.

- Assist with identifying your charitable purpose

- Define your mission statement.

- Help you comply with statutory formalities.

Charitable Companies

Charitable Companies are a common legal structure for running a charity. They offer the same benefits as a company and are regulated by both charity and company law.

What is a Charitable Company?

A Charitable Company is an incorporated body registered as a charity at Companies House. As a corporate body, your charity is legally considered a person in the same way as an ordinary individual. This enables your charity to engage with legal matters in its own name, such as: employing staff, entering contractual agreements, and owning land and assets. Charitable Companies can only be limited by guarantee, which means they have no shareholders, only members who agree to contribute a pre-determined amount in the event of the charity being wound up (the guarantee).

Our core charity services

We deliver work that meets each client’s needs in a bespoke manner and offer legal support on an ad hoc basis. Our services include:

- Defining your charitable objects and mission statement.

- Assistance with attaining registered status.

- Ongoing governance support as required pre- and post-incorporation.

- Maintaining your statutory registers in electronic form.

- Handling all requisite filings.

- Your charity’s first board minute.

Should you have any queries outside the scope of our expertise, we are happy to put you in touch with others that can advise you.

Charity Structure

Choosing the correct structure for your charity depends on your aims, we can help you decide which structure is right for you.

Are your aims exclusively charitable?

I.e., not just for the benefit of the community? And, if so, does that purpose provide a public benefit? It’s important to understand what constitutes an exclusively charitable purpose.

Once you’ve established your charitable purpose, consider this:

Does a charity already exist that shares the same aims, benefits the same group of people, and operates in a similar location?

If you answered ‘Yes’, collaboration would be a better approach. Working together prevents charities from competing for resources and funding, allowing them to better serve their beneficiaries.

Are you aware of restrictions and Charity Compliance?

Being classed as a charity will restrict your activities and you should therefore ensure that the restrictions will not adversely affect your aims – for example, you will need to be aware of and comply with Charity Law, and provide up-to-date information on your activities, finances and leading personnel to the Charity Commission and possibly other bodies.

You will not be able to carry out certain political activities, you will need to be able to make independent decisions about the charity’s work and you (or anyone connected to you), as a founder or trustee, will not be able to benefit personally from the charity (without certain limited criteria being fulfilled).

If any of these adversely affect what you wish to do, then a charity is probably not the best option and you should consider an alternative form.

Charity Disputes

Our Dispute Resolution lawyers cover a full range of disputes from the complex and high value to the more modest. We represent clients in court, arbitration tribunals and use alternative procedures, including mediation, to resolve disputes.

Our Dispute Resolutin team can support you with:

- Business Disputes

- Contract Disputes

- Data Protection Breach

- Land & Property Disputes

- Intellectual Property Disputes

- Professional Negligence

- Debt Recovery

FAQs

How much does it cost to set up a Charity?

Registration of charities with the Charities Commision or other relevant regulatory bodies is a complex process and takes time, however, we can assist you with an initial review of what route you should take and what considerations you should be taking.

What does Charity Compliance / Charity Governance Involve?

Governance and Secretarial – This will be at the heart of reputational compliance providing a robust governance framework, management of risk and impactful resource management.

This involves supporting trustees in understanding their roles, responsibilities and duties.

The wider aspect of good governance is also ensuring that the registers of the charity are well maintained and the relevant filings are made within the applicable timescales. This requires accuracy and timeliness of record keeping.

Good minute taking coupled with high quality documentation of decisions will demonstrate the strength of good governance.

We are able to provide tailored training sessions for trustees to ensure that they remain up to date with legal requirements applicable to them and to the charity.

Employment – Staff and volunteers are some of your key assets, the external face of the charity, which is why we will support you with developing your policies on human resources, recruitment, pensions, conduct and disciplinary issues.

Commercial – We can assist with all aspects of contracts and agreements or new vendor or outsourcing arrangements.

Property– Similarly, depending on each specific situation there may be instances where land or property transfers are required, or terms of use need to be negotiated. Our property team will be able to guide you through those negotiations and ensure that appropriate documentation is in place.

Regulation – As you grow, we can help you manage relationships with the regulators.

Growth – Depending on how quickly you envisage this happening, we can engage with you in your fundraising effort.

What is a Charitable Incorporated Organization?

What is an Unincorporated Charity?

An unincorporated charity is simply an individual or group of people operating as a not-for-profit organisation under the same name for a legally valid charitable purpose. Since these associations are unincorporated, they are not treated by the law as legal individuals. This means that the association’s members do not benefit from limited liability, rendering them personally liable to the charity’s financial obligations.

What is a Charitable Company?

A Charitable Company is an incorporated body registered as a charity at Companies House. As a corporate body, your charity is legally considered a person in the same way as an ordinary individual. This enables your charity to engage with legal matters in its own name, such as: employing staff, entering contractual agreements, and owning land and assets. Charitable Companies can only be limited by guarantee, which means they have no shareholders, only members who agree to contribute a pre-determined amount in the event of the charity being wound up (the guarantee).

Who is eligible to be a trustee?

The below criteria applies not only to trustees being appointed at the start of a charity’s life but throughout it, and the criteria and each trustee’s eligibility should be reviewed throughout the charity’s development cycle as part of the charity’s ongoing governance procedures.

Age

A charity trustee must be at least 18 years of age (unless the charity is a company or a charitable incorporated organisation when the minimum age is 16).

Disqualification

You can not be a Trustee if you are disqualified (nor can you hold a senior management position within a charity) unless you receive a waiver from the Charity Commission. A person would be disqualified from acting by means of:

- An unspent conviction for:

- An offence involving dishonesty or deception;

- Specified terrorism offences or being a designated person (under specific anti-terrorist legislation);

- A specified money laundering offence;

- Contravening a Charity Commission Order or Direction;

- Offences of misconduct in public office, perjury or perverting the course of justice.

- Automatic disqualification rules apply to those who are:

- Currently declared bankrupt or subject to bankruptcy restrictions or an interim order) or have an individual voluntary arrangement with creditors;

- On the sex offenders’ registers;

- Disqualified from being a company director;

- Removed from a trustee role by either the Charity Commission or the High Court due to misconduct and or mismanagement.

Non-UK Residents

Non-UK residents and non-British citizens can be appointed as Trustees as long as they meet the eligibility criteria’s and the Charity’s governing document does not restrict the residential status of your trustees. You would also need to ensure that your proposed Trustee was able to meet their obligations and carry out their role and responsibility including the attendance of trustee meetings.

Working with children and vulnerable adults

If the charity is going to work with children and/or vulnerable adults then disclosure and barring service checks will need to be undertaken where appropriate, as by law, anyone who has previously been barred by the Independent Safeguarding Authority from working with children or vulnerable adults can not take on a role that would give them access to anyone in those groups.

I want to start up a charity, what do I need to consider first?

This note is in respect of setting up a charity in England and Wales only.

Firstly, you need to consider whether setting up a charity will actually achieve your aims.

As a starting point consider the following:

- Are your aims exclusively “charitable”, ie. not just for the benefit of the community? and, if so, do those aims provide a public benefit? Check what falls within a charitable purpose.

If you answered No, then you should consider an alternative entity than a charity. - Does a charity already exist that has the same charitable aims for the benefit of the same beneficiaries and if location dependent in the same location?

If you answered Yes, it would be better to try and work together so that both charities are not competing for resources and funding.

-

Being classed as a charity will restrict your activities and you should therefore ensure that the restrictions will not adversely affect your aims – for example you will need to be aware of and comply with Charity Law, you will need to provide up to date information on your activities, finances and leading personnel to the Charity Commission (f you are a registered charity) and others; you will not be able to carry out certain political activities; you will need to be able to make independent decisions about the charity’s work and you (or anyone connected to you), as a founder or trustee, will not be able to benefit personally from the charity (without certain limited criteria being fulfilled.

If any of these will adversely affect what you wish to do then a charity is probably not the best option and you should consider an alternative entity.

If your responses to the above have continued to lead you towards considering setting up a charity then the next thing to do is decide on who will act as Trustees. You should aim to have at least three trustees appointed and they should be unconnected to each other with a good range of skills to enable the charity to be run and managed effectively, it stands to reason that they will also have an interest in the work of the charity. You should all work together to set up the charity and agree the charity’s purposes and identify who will benefit from it’s work. Trustees will need to be eligible so check the Trustee eligibility criteria.

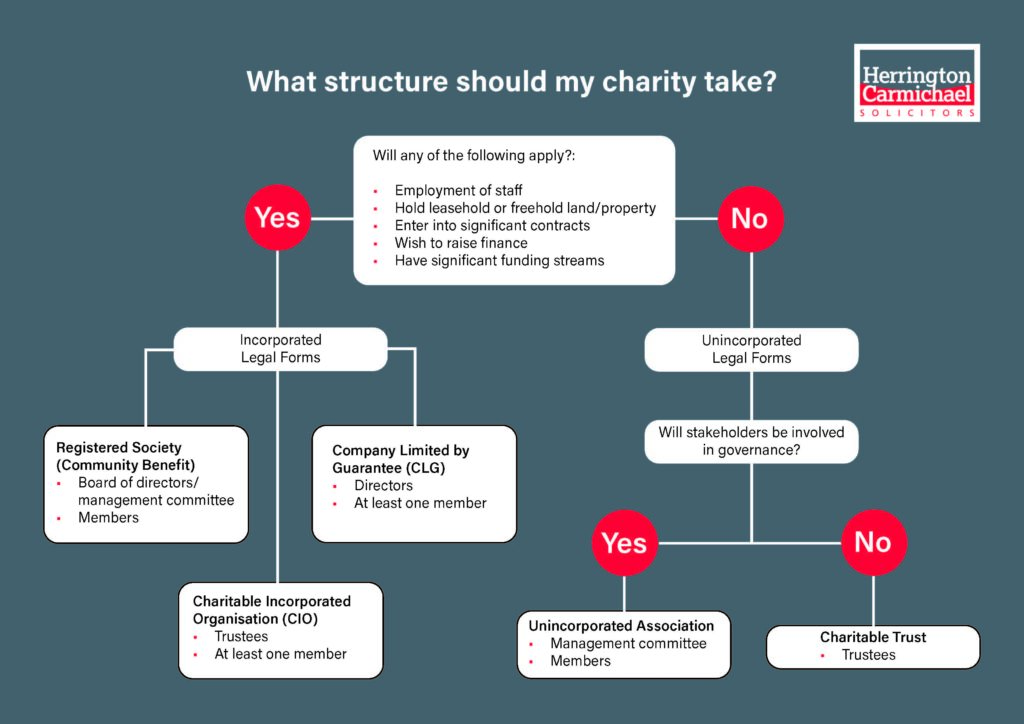

Your next consideration will by what charity structure you wish to utilise, the charity structure flow-chart (please see FAQ below) will provide you with an idea of the considerations you need to make.

Once you have had an opportunity to consider the above and the additional information provided within the links then please contact us for further guidance and assistance.

What structure should my charity take?

What are the alternatives to setting up a charity?

If you have come to the conclusion that a charity may not be the right choice for you at this time – consider some of the following alternatives:

Social Enterprise

A social enterprise is a business that has social, environmental or community-based objectives but do not meet the “charitable purposes” test. You can use a limited company, a co-operative, a community interest company or simply trade as a sole trader or business partnership.

Set up a named fund or trust

The setting up of a named fund if you want to raise money for a certain cause saves time and effort of setting up and running a charity.

You can set up a fund through a community foundation or if you have more than £10,000 to donate you could consider a Charities Aid Foundation (CAF) charitable trust (www.cafonline.org )

Setting up a trust fund for the benefit of certain individuals would be an alternative if there is no “charitable purpose” or it will not be for public benefit.

What are the 13 categories of charitable purposes as set out within the Charities Act 2011?

- The prevention or relief of poverty.

- The advancement of education.

- The advancement of religion.

- The advancement of health or the saving of lives.

- The advancement of citizenship or community development.

- The advancement of the arts, culture, heritage or science.

- The advancement of amateur sport.

- The advancement of human rights, conflict resolution or reconciliation or the promotion of religious or racial harmony or equality and diversity.

- The advancement of environmental protection or improvement.

- The relief of those in need, by reason of youth, age, ill-health, disability, financial hardship or other disadvantage.

- The advancement of animal welfare.

- The promotion of the efficiency of the armed forces of the Crown, or of the efficiency of the police, fire and rescue services or ambulance services.

- Any other charitable purpose!

There are of course definitions of what falls within the above categories but the above provides a wide starting point for you to begin your considerations.

Which category does your proposed charity fall within? Or, of course, it could fall within a number of categories, if so, decide in which order they take precedence and always be aware that the purpose must be for public benefit.

Charity Insights

Meet the Team

Related expertise

Best Law Firms 2024

Herrington Carmichael has once again been named in the Times Best Law Firms. We were first listed in 2023 and have once again made the Best Law Firms list for 2024.