A demerger is the process through which a single business entity is divided into separate companies or groups of companies. There are a number of motivations behind a demerger, such as resolving shareholder disputes, separating different elements of a business and improving the value of an element of a business.

Three-cornered demerger – what is it and why use it?

Contrary to the statutory demerger process, a brief summary of which can be found here, a three-cornered demerger incorporates a capital reduction. Under a three-cornered demerger, therefore, a new holding company is formed separately to the existing company, and the demerging business is then declared as a dividend in specie by the existing company to the new holding company, which simultaneously reduces its capital. This is sometimes seen as the preferred route for parties as it ensures that the demerged business transfers to a completely new entity that has no links to the existing company. This allows the demerged businesses to flourish independently without reliance on each other.

Case study – national network infrastructure company

In December 2019, Herrington Carmichael LLP completed the demerger of a national network infrastructure company. This demerger was achieved through the three-cornered route, and an assessment of the procedure implemented in this case demonstrates the key considerations that should be made in all similar situations.

How the demerger arose

The company (“Original Company”) was operating two separate strands of business (“Business A” and “Business B”) through a single corporate entity, with the original shareholders still at the helm. The key motivations for the demerger were:

- the split into two businesses resulted in an inefficient allocation of resources;

- decision making for both businesses was slowed down; and

- some of the original shareholders wished to retire.

Why a three-cornered demerger was used

Considering the above motivations, the shareholders concluded that two separate corporate entities was the best solution, and a three-cornered demerger would suit their requirements.

Pre-demerger considerations

A number of pre-demerger considerations had to be made, which included:

- HM Revenue and Customs’ approval in light of the tax advantages available;

- the value of the Original Company due to the need to divide it following the demerger;

- determining whether or not to exercise any pre-agreed employee incentive schemes which would alter the shareholdings; and

- the incorporation of the three new companies.

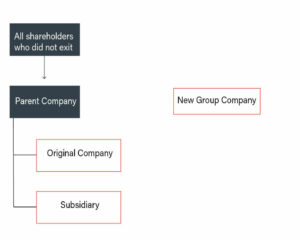

With regard to the incorporation of the new companies, the first was to be the parent company of the Original Company by way of a share for share swap with the shareholders (“Parent Company”), the second was to be entirely separate from the group (“New Group Company”), and the third was to be the subsidiary of the Original Company, into which Business B was transferred (“Subsidiary”).

Additionally, at the incorporation stage, the shares in the Original Company that were held by those shareholders wishing to retire were purchased by the Parent Company, thereby achieving their goal of leaving the business.

Although the above is not an exhaustive list of pre-demerger considerations, they nonetheless provide a useful guide as to what steps should be taken.

Demerging

Following the incorporation of the various new companies, the corporate structure of the business appeared as follows:

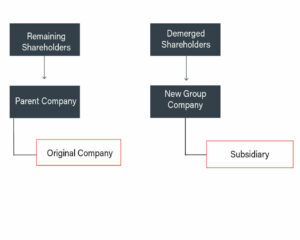

The Parent Company and the New Group Company then entered into a demerger agreement, under which the Parent Company sold all of the shares in the Subsidiary to the New Group Company, resulting in the Subsidiary becoming the wholly owned subsidiary of the New Group Company.

In consideration for these shares, the New Group Company issued shares to those shareholders of the Parent Company who would be involved in Business B, and cancelled the shares held in it by those shareholders (the reduction of capital previously discussed).

Overall, the demerger agreement and the preceding matters resulted in two new corporate groups being formed in accordance with the below diagram, thereby achieving the shareholders’ goals of separating Business A and Business B:

How can we help?

How can we help?

While this case study only provides a simplified overview of the three-cornered demerger process, it still highlights its usefulness and complexities, both from a legal and taxation perspective.

If you are considering a demerger or other corporate reorganisation and would like to speak to someone in our corporate department to discuss matters in more detail, please contact either Yavan Brar at yavan.brar@herrington-carmichael.com or 0118 977 4045 or Matthew Lea at matthew.lea@herrington-carmichael.com or 0118 977 4045.

For more insights on COVID-19 and how we can assist you or your business, visit our COVID-19 hub here.

This reflects the law at the date of publication and is written as a general guide. It does not contain definitive legal advice, which should be sought as appropriate in relation to a particular matter.