Employee Incentive Schemes

Employee Incentive Schemes are a strategic initiative implemented by a company to reward, retain and recruit its employees for achieving specific goals, improving performance, or contributing to the overall success of the business.

Employee Incentive Schemes

In the UK, implementation of an employee incentive scheme provides employees with the option to acquire shares in their employer company (or a member of its group).

Such schemes can therefore be useful in incentivising performance and aligning employees’ interests with the shareholders and management team.

On the grant of a share option scheme, the option holder will be granted the right to acquire shares in the company at a pre-determined price in the future. The option holder will not actually acquire the shares under option until the option is exercised – which can be dependent on factors such as satisfying certain performance criteria, and/or a future sale of the company.

At the point the option is exercised, the option holder will become a shareholder of the company.

When an employee becomes a shareholder, they will enjoy the benefit of the rights attached to the class of shares that they hold. For example:

- Dividends – the right to receive a distribution of the company’s profits after tax;

- Return of capital – the right to participate in the surplus assets available for distribution after the company’s creditors have been paid in a liquidation of the company;

- Voting rights – the right to attend and vote at general meetings of the company, or exercise one vote per share on a poll.

What is a share scheme?

A share scheme is a way of founders sharing equity with employees. Equity in a company means ownership – anyone who holds shares in a company owns part of the company (and therefore its assets).

There are many different forms of share scheme, but they all work in one of two ways:

Equity now – employees are given actual shares in the company now

Equity later – employees are granted an option which gives them a right to purchase shares in the company at a certain point in the future (at an agreed price)

Enterprise Management Incentive (EMI) Scheme

An EMI scheme provides selected employees with the option to acquire shares in your company in the future. You will have discretion to decide who participates, and the scheme can be tailored to different employees’ role, seniority, and the value they bring to the business.

If required, the options can be subject to certain exercise conditions. This means that employees will be motivated to work hard, to ensure that the conditions are satisfied, and they will therefore be able to exercise their options. Typical EMI schemes include conditions relating to an exit of the company, time, and performance criteria. The flexibility of the scheme allows you to create a bespoke plan, tailored to the needs of your business.

To be able to grant EMI options, there are qualifying criteria that both the company and the proposed option holder must satisfy. In relation to the company, the conditions relate to matters such as the assets of the company, the number of employees, and trading activities. In relation to the employee, the conditions relate to their working patterns.

As EMI schemes are approved by HMRC, the tax treatment for both the company and the employee is favourable.

Long Term Incentive Plan (LTIP)

An LTIP is an employee incentive arrangement where participators’ performance is measured over a period of time.

LTIPS usually involve participation by senior executives, and the incentive usually involves the provision of ‘free shares’ on the satisfaction of certain performance conditions over a period of time.

LTIPs are a useful tool in aligning interests of employees who are able to influence the success of the company. Offering competitive LTIPs can also make your company attractive for prospective candidates, whilst also contributing to employee retention, and achieving sustainable growth.

Company Share Option Plan

A Company Share Option Plan (CSOP) scheme provides employees with an option to acquire shares in the company at a later date.

To qualify to grant CSOP options, the company must meet certain criteria. Provided the criteria are satisfied, favourable tax treatment will apply for both the company and the employees who are part of the scheme.

You have discretion to decide who will participate in the scheme, and the exercise of shares under CSOPs can also be subject to the satisfaction of certain performance conditions if required.

Growth, Hurdle & Flowering Shares

Growth Share Schemes are strategic initiatives that can be used to incentivise key employees by rewarding them in line with future business growth.

These types of incentives should be considered if it is anticipated that your company will achieve substantial growth in the future.

Growth shares allow the holders to benefit only from the growth in value of the company from the time the shares are awarded, which can motivate employees to achieve growth for the company.

EMI Schemes for Startups

Employee Share schemes (EMI Schemes) can be equally, if not more, beneficial to startups with few employees than to large companies with many employees.

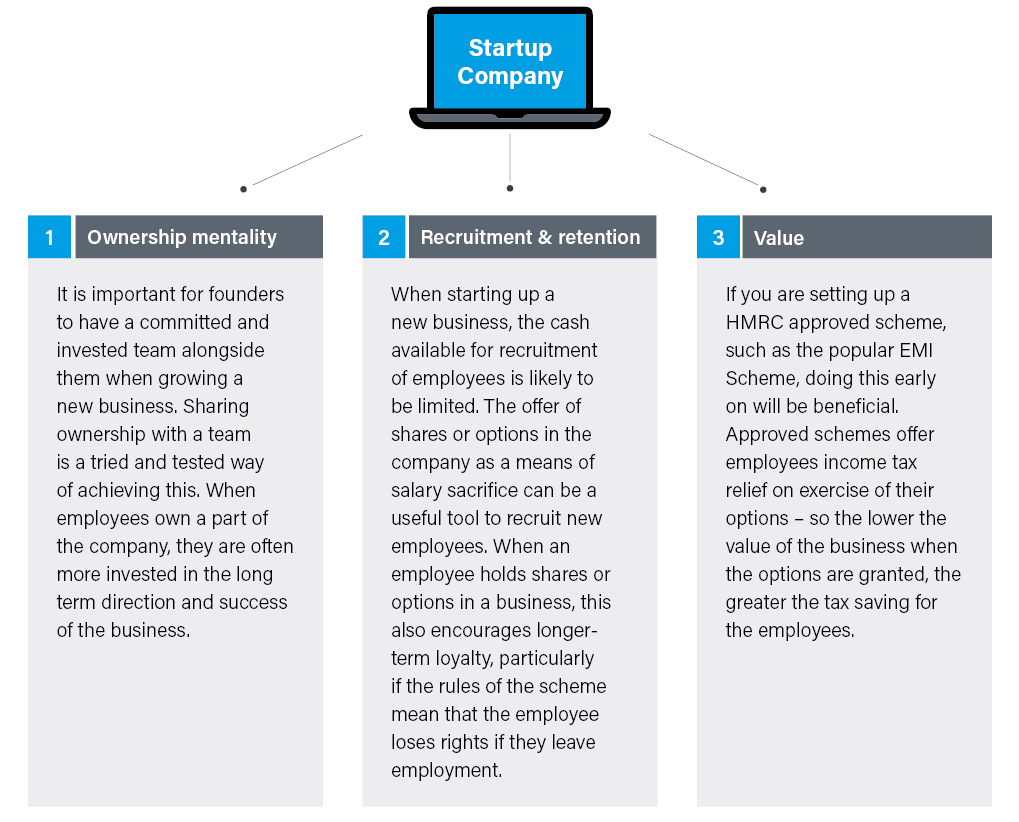

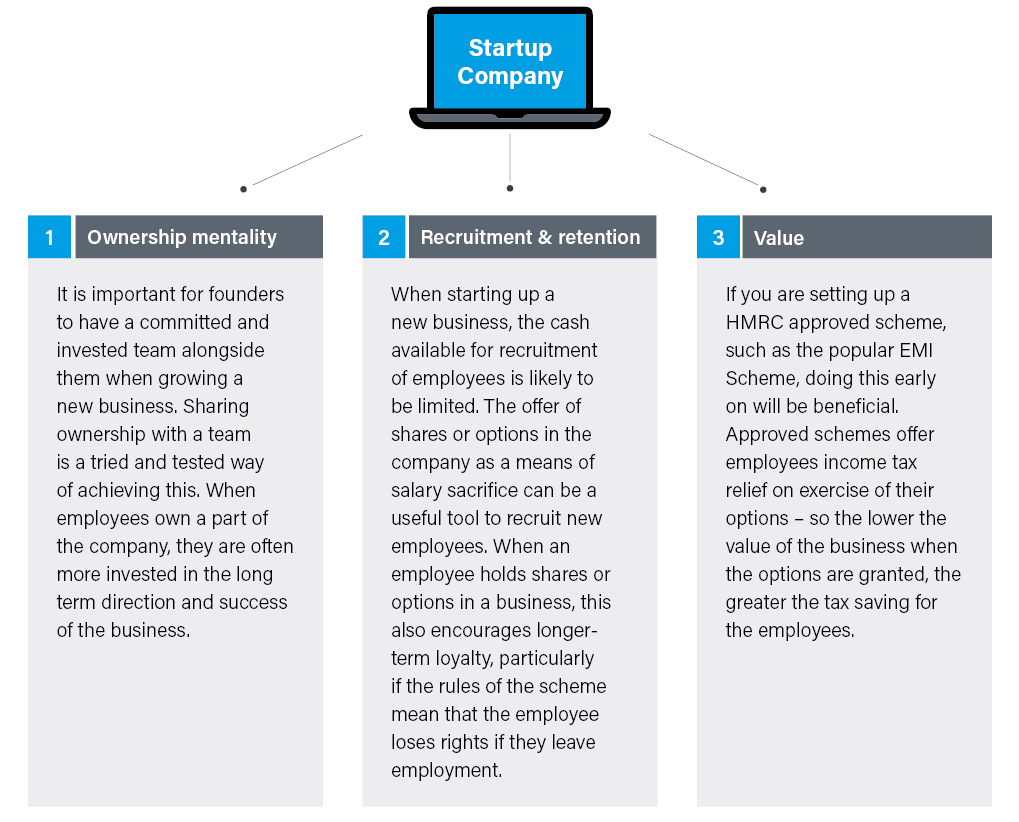

Why should startups offer equity?

What is a share scheme?

A share scheme is a way of founders sharing equity with employees. Equity in a company means ownership – anyone who holds shares in a company owns part of the company (and therefore its assets).

There are many different forms of share scheme, but they all work in one of two ways:

Equity now – employees are given actual shares in the company now

Equity later – employees are granted an option which gives them a right to purchase shares in the company at a certain point in the future (at an agreed price)

Enterprise Management Incentive (EMI) Scheme

An EMI scheme provides selected employees with the option to acquire shares in your company in the future. You will have discretion to decide who participates, and the scheme can be tailored to different employees’ role, seniority, and the value they bring to the business.

If required, the options can be subject to certain exercise conditions. This means that employees will be motivated to work hard, to ensure that the conditions are satisfied, and they will therefore be able to exercise their options. Typical EMI schemes include conditions relating to an exit of the company, time, and performance criteria. The flexibility of the scheme allows you to create a bespoke plan, tailored to the needs of your business.

To be able to grant EMI options, there are qualifying criteria that both the company and the proposed option holder must satisfy. In relation to the company, the conditions relate to matters such as the assets of the company, the number of employees, and trading activities. In relation to the employee, the conditions relate to their working patterns.

As EMI schemes are approved by HMRC, the tax treatment for both the company and the employee is favourable.

Long Term Incentive Plan (LTIP)

An LTIP is an employee incentive arrangement where participators’ performance is measured over a period of time.

LTIPS usually involve participation by senior executives, and the incentive usually involves the provision of ‘free shares’ on the satisfaction of certain performance conditions over a period of time.

LTIPs are a useful tool in aligning interests of employees who are able to influence the success of the company. Offering competitive LTIPs can also make your company attractive for prospective candidates, whilst also contributing to employee retention, and achieving sustainable growth.

Company Share Option Plan

A Company Share Option Plan (CSOP) scheme provides employees with an option to acquire shares in the company at a later date.

To qualify to grant CSOP options, the company must meet certain criteria. Provided the criteria are satisfied, favourable tax treatment will apply for both the company and the employees who are part of the scheme.

You have discretion to decide who will participate in the scheme, and the exercise of shares under CSOPs can also be subject to the satisfaction of certain performance conditions if required.

Growth, Hurdle & Flowering Shares

Growth Share Schemes are strategic initiatives that can be used to incentivise key employees by rewarding them in line with future business growth.

These types of incentives should be considered if it is anticipated that your company will achieve substantial growth in the future.

Growth shares allow the holders to benefit only from the growth in value of the company from the time the shares are awarded, which can motivate employees to achieve growth for the company.

EMI Schemes for Startups

Employee Share schemes (EMI Schemes) can be equally, if not more, beneficial to startups with few employees than to large companies with many employees.

FAQs

Why set up an employee share scheme?

There are many benefits associated with shared employee ownership for businesses. The most common reasons we see employers wanting to set up schemes include:

- Recruitment of top talent, particularly when the recruitment market is tough

- Retention of the best talent

- Creation of an ownership culture amongst employees

- To motivate employees to improve their performance and productivity

- Reward employees (similar to a cash bonus scheme)

- To keep up with competitor firms in the industry

What are the different types of share schemes?

There are various types of scheme, some of which are suited to larger companies and some more suited to small companies or start-ups with only two or three founders. Four of the available schemes are “approved” by HMRC which means that they are tax-efficient for the employees receiving shares/options. These are:

- Enterprise Management Incentives (EMIs)

- Company Share Option Plans (CSOPs)

- Share Incentive Plans (SIPs)

- Save As You Earn (SAYE)

EMIs are probably the most popular, particularly with start-ups and in IT / technology industries.

Other schemes are “unapproved” and are potentially not as tax-efficient. These include:

- Growth shares

- Unapproved share options

- Nil paid shares

Which type of share scheme is right for my business?

The best share scheme for a business will depend on its size, industry, employees and motivations for implementing a scheme. Some examples of recent share schemes we have helped clients with include:

Company 1: start-up business where the founder shareholder brought in an employee who he wanted to motivate to grow the business with the aim of a sale in 8-10 years. We assisted the company in obtaining a valuation for EMI purposes from HMRC of £1 per share. EMI options were granted to the employee who can exercise them on a sale of the company.

Company 2: a founder shareholder wanted to reduce his shareholding over time for personal tax planning reasons and to pass on ownership to employees. The company did not qualify for EMI due to operating an excluded trade but did qualify for a CSOP scheme. Some employees were family members so did not qualify for beneficial tax treatment of CSOPs, but instead received unapproved options.

Company 3: company had an existing EMI scheme exercisable by employees on a sale of the company. The shareholders decided they wanted some longstanding overseas employees and consultants to also benefit from the sale. Immediately prior to sale, those employees and consultants were granted unapproved options which were exercised on the sale.

Company 4: company currently valued at £11m wanted to motivate its management team to participate in the future growth of the business. The management team were issued with growth shares which only entitle them to a return on any amounts in excess of £11m when the company is sold.

Which companies can use EMIs?

EMIs are most commonly implemented by entrepreneurial companies of small to medium size. To qualify companies must meet certain criteria. They must:

- Be independent, therefore not a 51% subsidiary of another company and any subsidiaries your company may have must also qualify.

- Carry on a “qualifying trade” – certain trades are excluded, for example banking, insurance, property development, farming and hotel management.

- Have fewer than 250 full time employees

- Have gross assets of less than £30m

- Be permanently established in the UK

What are the advantages of an EMI?

EMIs are relatively simple schemes to implement and are, in turn, easy for the employees concerned to understand.

EMIs are HMRC ‘approved’, meaning that they receive favourable tax treatment is in relation to both the company and employees.

Companies benefit from a Corporation Tax deduction, given in the accounting year in which the options are exercised, equal to the gain made by the employee.

For the employees the advantages relate to Income Tax. The relevant employee will have no Income Tax liability on the grant of the option and there will be no Income Tax liability on exercise if, at exercise, the exercise price was at least equal to the market value of the shares as of the date the option was granted. There will also be no National Insurance Contributions (NICs) if no income tax is due.

Why should start-ups offer equity?

Implementing a share scheme in the early stages of a company’s growth can assist with:

- Recruitment & retention – employees will be inclined to stay with the company long term to satisfy the conditions required to exercise their option, and therefore benefit from the rights attached to the shares that they will acquire;

- Improved performance – employees will be motivated by their ability to participate in profits as the company grows, and are therefore likely to perform well to meet the necessary targets; and

- Driving value – the possibility of acquiring shares will align the incentives of employees and founders to increase the company’s growth and profits.

Which share scheme is best for a startup?

There is a typical “lawyer’s answer” to this question, which is – it depends! The scheme that is best suited to a company depends on the founders’ motivations, which could range from tax effectiveness, affordability or security for their own interests. Some of the HMRC approved schemes also have limitations, such as certain trades not being eligible and limitations on the number of employees the company can have.

We would recommend that you seek professional advice to explore the various schemes and work out which is best for your business.

How much equity should a startup set aside?

This is a decision for the founders of the business to make and will depend on how much equity they want to retain for the future. Founders will also need to consider the requirements of any current or potential external investors such as VCs. Typically, we see smaller businesses set an option pool of between 10-20%.

Legal Insight

Meet the Team

Related expertise

Best Law Firms 2024

Herrington Carmichael has once again been named in the Times Best Law Firms. We were first listed in 2023 and have once again made the Best Law Firms list for 2024.