EMI Scheme Lawyers

Enterprise Management Incentive (EMI) Schemes provide selected employees with the option to acquire shares in the company that they work for.

Enterprise Management Incentive Scheme

Setting up an EMI scheme, the company must satisfy certain conditions. The employees who are to be granted options must also satisfy conditions in relation to their working arrangements. If the conditions are met, favourable tax treatment will apply for both the company and the employee.

An EMI scheme consists of an Option Agreement, and the Plan Rules. The Option Agreement itself can be tailored to consider factors such as job role, seniority and the value different employees bring to the business. The scheme can therefore apply to different employees in different ways.

Sharing Equity

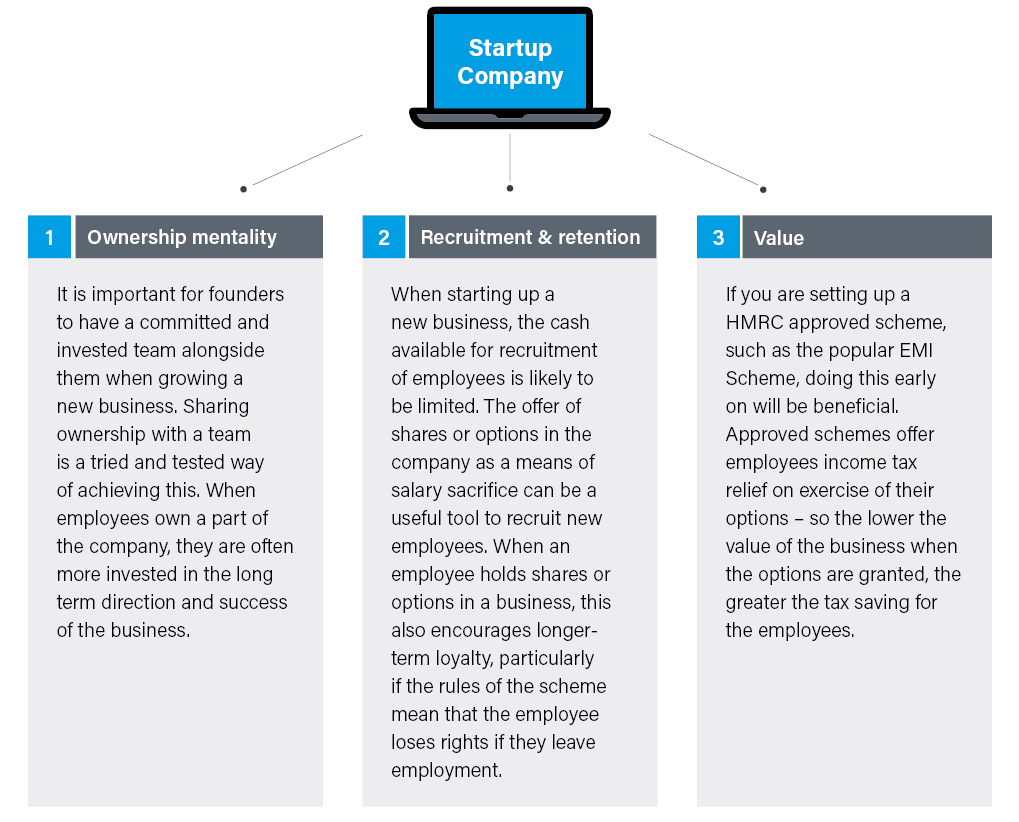

There are a number of other benefits to setting up a company share scheme, but as a founder of a startup, growth will most likely be your key motivator.

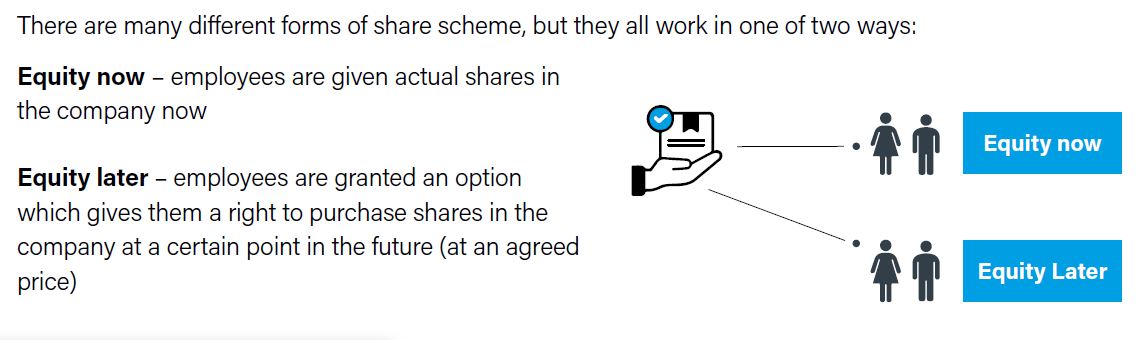

A share scheme is a way of founders sharing equity with employees. Equity in a company means ownership – anyone who holds shares in a company owns part of the company (and therefore its assets).

A guide for startups

Why should startups offer equity?

Share schemes can be equally, if not more, beneficial to startups with few employees than to large companies with many employees. Setting up a share scheme early on can assist with:

I am a heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Proin justo metus, dictum mattis ipsum in, dapibus condimentum ligula. Nunc egestas elementum accumsan. Cras hendrerit id odio eu fringilla. Aenean at sagittis turpis.

FAQs

Which companies can use EMIs?

- Be independent, therefore not a 51% subsidiary of another company and any subsidiaries your company may have must also qualify.

- Carry on a “qualifying trade” – certain trades are excluded, for example banking,

- insurance, property development, farming and hotel management.

- Have fewer than 250 full time employees

- Have gross assets of less than £30m

- Be permanently established in the UK

What are the advantages of an EMI?

EMIs are relatively simple schemes to implement and are, in turn, easy for the employees concerned to understand.

Which share scheme is best for a startup?

There is a typical “lawyer’s answer” to this question, which is – it depends! The scheme that is best suited to a company depends on the founders’ motivations, which could range from tax effectiveness, affordability or security for their own interests. Some of the HMRC approved schemes also have limitations, such as certain trades not being eligible and limitations on the number of employees the company can have. We would recommend that you seek professional advice to explore the various schemes and work out which is best for your business.

Types of share scheme

- Enterprise Management Incentives (EMIs)

- Company Share Option Plans (CSOPs)

- Save As You Earn (SAYE)

- Share Incentive Plans (SIPs)

- Growth Shares

- Unappoved Options

Meet the Team

Related expertise

Best Law Firms 2024

Herrington Carmichael has once again been named in the Times Best Law Firms. We were first listed in 2023 and have once again made the Best Law Firms list for 2024.